In these tough times, it’s not easy to come up with the money you need, especially if you need it right away. If you’re looking for a small loan to cover a shortfall, you may be wondering how you can get one instantly.There are a few ways to get a small loan quickly. You could try a payday loan, which is a short-term loan that you pay back in a single installment. Payday loans can be a good option if you need money quickly and you’re confident that you can repay the loan on time.

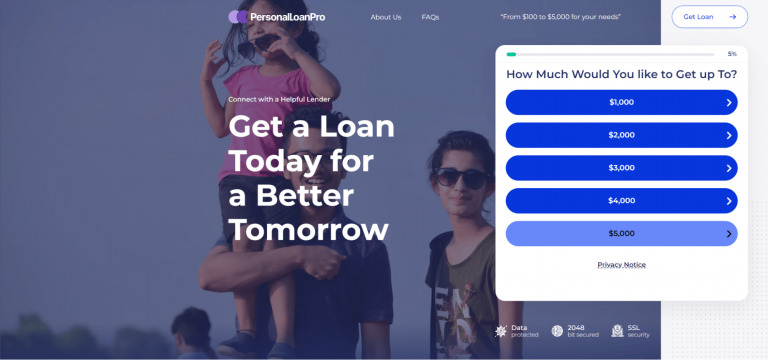

Another option is a personal loan from a bank or credit union. Personal loans typically have lower interest rates than payday loans, and you can typically borrow more money. However, personal loans can take longer to approve than payday loans, so you may need to apply before you know you’re approved. Personal Loan Pro can offer you the loan option.

If you need money right away, you may also want to consider a credit card cash advance. With a cash advance, you can borrow up to your credit limit and repay the loan over a period of time. However, cash advances typically have high interest rates, so you should only use them as a last resort.

No matter what option you choose, be sure to read the terms and conditions carefully before you sign anything. It’s important to understand all the costs associated with taking out a small loan, so you can make the best decision for your needs.

What Is A Small Loan?

What is a small loan?A small loan is a loan that is typically less than $5,000. Small loans are often used to finance personal expenses or to consolidate debt.

Small loans can be a great option for borrowers who need a loan but don’t have a lot of money to borrow. Small loans typically have lower interest rates and shorter terms than larger loans, making them a more affordable option for borrowers.

Small loans can be used for a variety of purposes, including:

- Consolidating debt

- Paying for a vacation

- Financing a home improvement project

- Paying for a wedding

Small loans are available from a variety of sources, including banks, credit unions, and online lenders. Borrowers should compare interest rates and terms from different lenders to find the best option for their needs.

Small loans can be a great option for borrowers who need a loan but don’t have a lot of money to borrow. small loans typically have lower interest rates and shorter terms than larger loans, making them a more affordable option for borrowers. And you can apply the small loan from Personal Loan Pro.

What Can I Use Small Loan For?

There are many reasons why people might need a small loan. Perhaps they need to cover an unexpected expense, or maybe they need money to help them get through a tough period. Whatever the reason, it’s important to know what your options are when it comes to borrowing money.One option is a small loan from a bank or credit union. These loans typically have a lower interest rate than a credit card, and they can be a good option if you need a relatively small amount of money. However, you will need to be able to prove that you can afford to repay the loan, and you may need to provide some collateral.

Another option is a personal loan from a lending company. These loans are typically unsecured, which means you don’t need to provide any collateral. However, the interest rates can be higher than those offered by banks and credit unions. It’s important to read the terms and conditions of any loan agreement carefully to make sure you understand the costs involved.

If you’re looking for a fast, easy way to get money, you might want to consider a payday loan. These loans are designed to be repaid quickly, usually within a few weeks. However, the interest rates can be quite high, so it’s important to weigh all of your options before deciding if a payday loan is right for you.

Whatever your needs may be, it’s important to do your research and find the best loan product for you. There are many options available, so take the time to find the one that best meets your needs.

Where Can I Get A Small Loan Instantly?

Looking for a small loan? You may be wondering where you can go to get one quickly and easily. Here are some tips on how to get a small loan instantly.Your best bet for getting a small loan quickly is to go online. There are a number of lenders who offer instant loans, so you can get the money you need in just a few minutes. Be sure to compare rates and terms from different lenders to make sure you’re getting the best deal.

Another option for getting a small loan quickly is to go to a payday lender. Payday lenders typically offer small loans with high interest rates, but they can be a good option if you need money quickly. Just be sure to read the terms and conditions carefully so you know exactly what you’re agreeing to.

If you need a small loan but don’t want to go through a lender, you may want to try a peer-to-peer lending site. These sites allow you to borrow money from individuals rather than from a bank or other financial institution. This can be a great option if you have a good credit score, as you may be able to get a lower interest rate than you would from a traditional lender.

No matter what route you choose, be sure to do your research and compare rates and terms before you sign anything. By taking the time to compare options, you can be sure you’re getting the best deal on your small loan.