When it comes to getting a loan, there’s no doubt that you want to find the best option possible. And, if you’re worried about your credit score, you may be wondering if you can get a loan without a credit check.The good news is that, in many cases, you can. There are a number of lenders who offer loans without a credit check, and there are also a variety of loan products available to those with bad credit.

However, it’s important to remember that not all loans are the same. If you’re looking for a loan without a credit check, you’ll likely need to pay a higher interest rate or accept a shorter repayment term. So, it’s important to weigh your options and make sure you’re getting the best deal possible.

If you’re interested in getting a loan without a credit check, start by shopping around for the best rates and terms. And, if you’re not sure where to start, consider talking to a lender or credit counselor for advice.

How To Get A Personal Loan With Bad Credit?

If you’re looking for a personal loan but have bad credit, don’t worry – there are still options available to you. Here are a few ways to get a personal loan with bad credit:

- Talk to your bank or credit union. Many smaller banks and credit unions offer personal loans to their customers, even if they have bad credit. Talk to a loan officer to see what your options are.

- Look for a loan from a peer-to-peer lender. Peer-to-peer lenders offer loans to people with bad credit, and they typically have lower interest rates than traditional lenders.

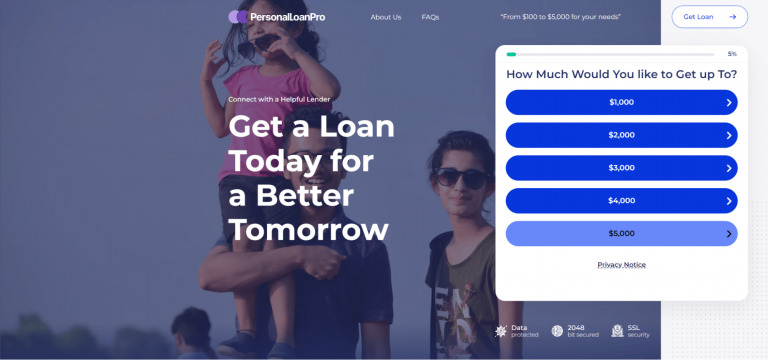

- Check with online lenders. There are a number of online lenders who offer personal loans to people with bad credit. Be sure to research the lender before you apply to make sure you’re getting a good deal. Personal Loan Pro would be a good option for you to choose.

- Consider a loan from a friend or family member. If you have a friend or family member who is willing to loan you money, you may be able to get a personal loan with very favorable terms.

No matter what option you choose, be sure to read the terms and conditions carefully and make sure you can afford the monthly payments. Having bad credit doesn’t mean you can’t get a personal loan – it just means you’ll need to be a bit more choosy about which lender you work with.

What’s The Minimum Credit Score For A Personal Loan?

Minimum credit score requirements for a personal loan vary by lender, but it’s usually safe to assume that you’ll need a score of at least 640 to qualify. However, if you have a history of on-time payments and a strong credit profile, you may be able to get a loan with a score as low as 580.To get the best interest rates on a personal loan, aim for a score of 720 or higher. Keep in mind that interest rates can vary significantly, so it’s important to compare offers from several lenders before you decide on a loan.

If you’re struggling to improve your credit score, there are a few things you can do to improve your standing. First, make sure you’re paying all of your bills on time, and try to keep your credit utilization ratio below 30%. You can also get a copy of your credit report and review it for errors. If you find any mistakes, dispute them with the credit bureau.

If you’re looking for a personal loan, it’s important to understand the minimum credit score requirements. By knowing what to expect, you can work on improving your credit score before you apply for a loan. Personal Loan Pro can do a credit check and will offer advice on what loan you can get and how to improve your credit score.

How To Increase The Credit Score?

A credit score is a three-digit number that reflects a person’s credit worthiness. The credit score is based on the credit report, which is a summary of a person’s credit history. Lenders use a person’s credit score to determine the interest rate on a loan.It is important to maintain a good credit score because a high credit score can qualify a person for a lower interest rate on a loan. A low credit score can result in a high interest rate and may lead to the denial of a loan.

There are several ways to improve a credit score. One way is to make on-time payments. Another way is to keep the credit utilization ratio low. The credit utilization ratio is the amount of credit used compared to the amount of credit available.

Another way to improve a credit score is to have a long credit history. A credit history is the record of a person’s credit transactions. Lenders look at the credit history to determine the credit score.

The best way to improve a credit score is to get a copy of the credit report and review it. The credit report lists the credit score and the credit history. The credit report also lists the accounts that are open and the payments that are late.

The credit score can be improved by paying the past-due accounts and by adding positive information to the credit report. A positive credit history includes on-time payments and a high credit score.

It is important to remember that a credit score is only one factor that lenders consider when making a loan decision. A person’s income, job history, and credit score are all considered when determining a person’s credit worthiness.